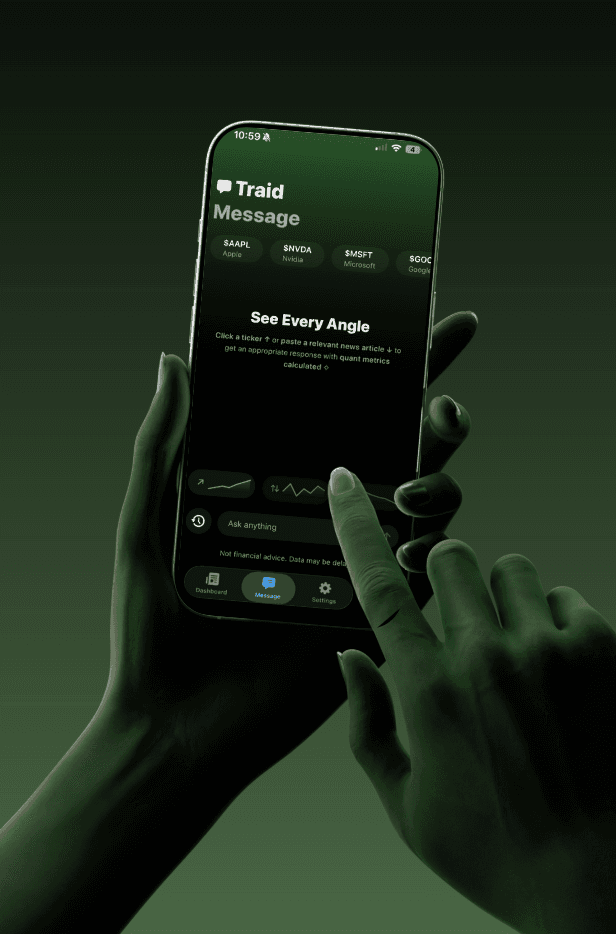

Sentiment Awareness Not Confirmation Bias

Sentiment Awareness Not Confirmation Bias

Sentiment Awareness Not Confirmation Bias

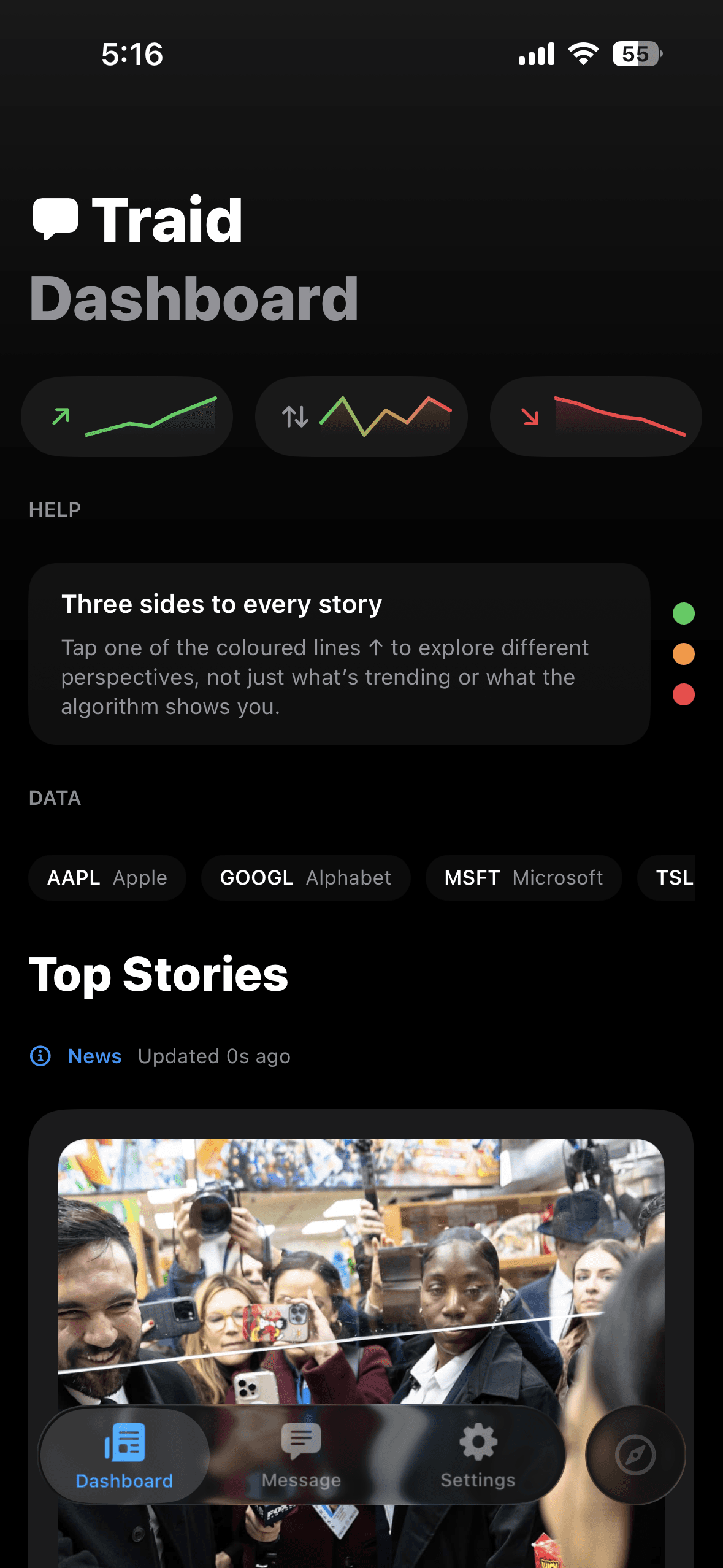

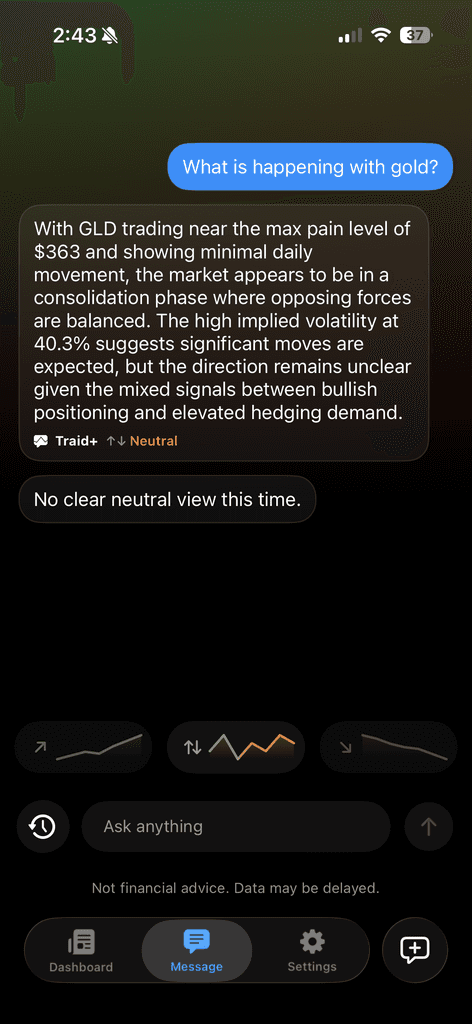

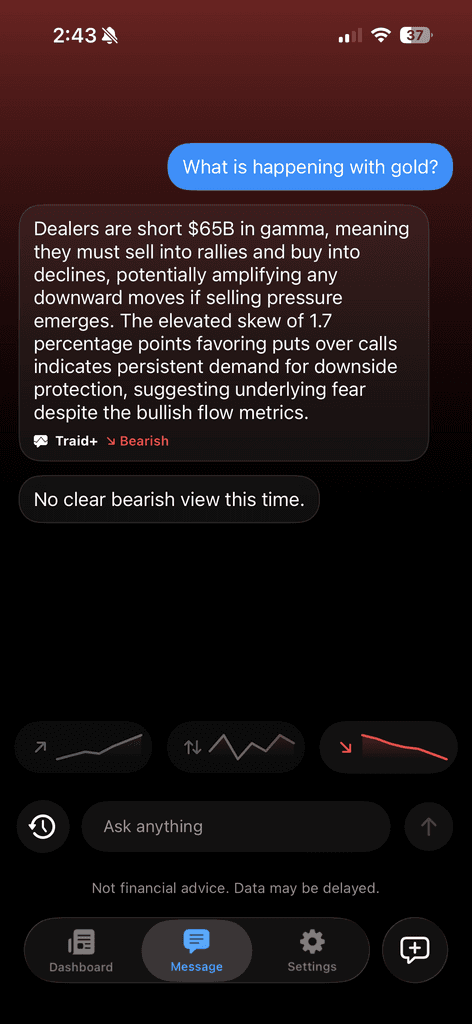

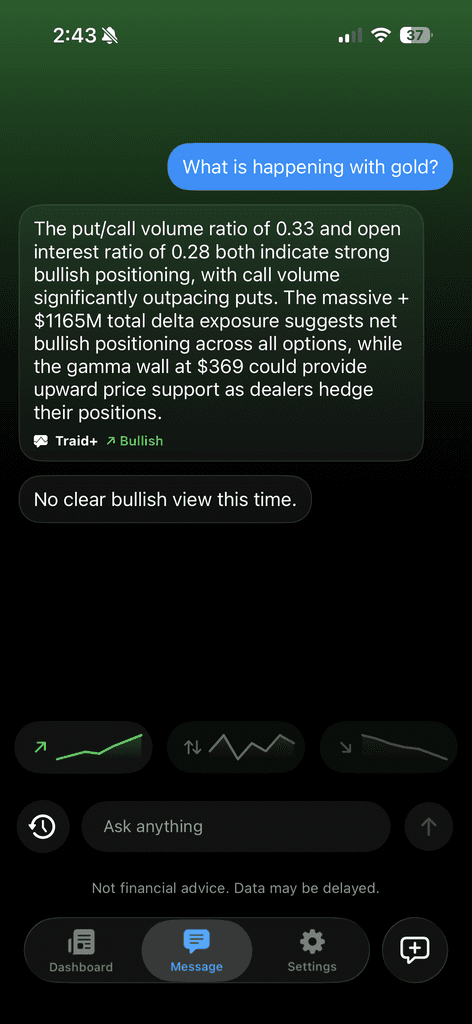

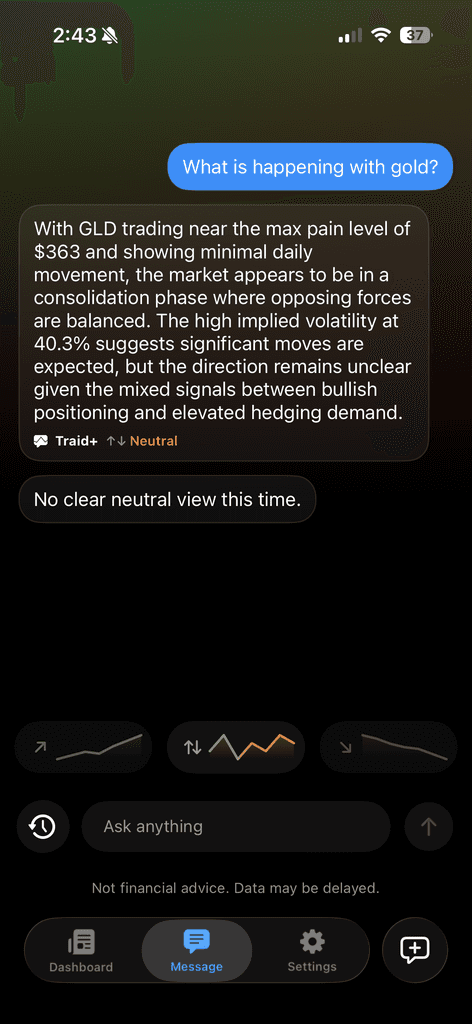

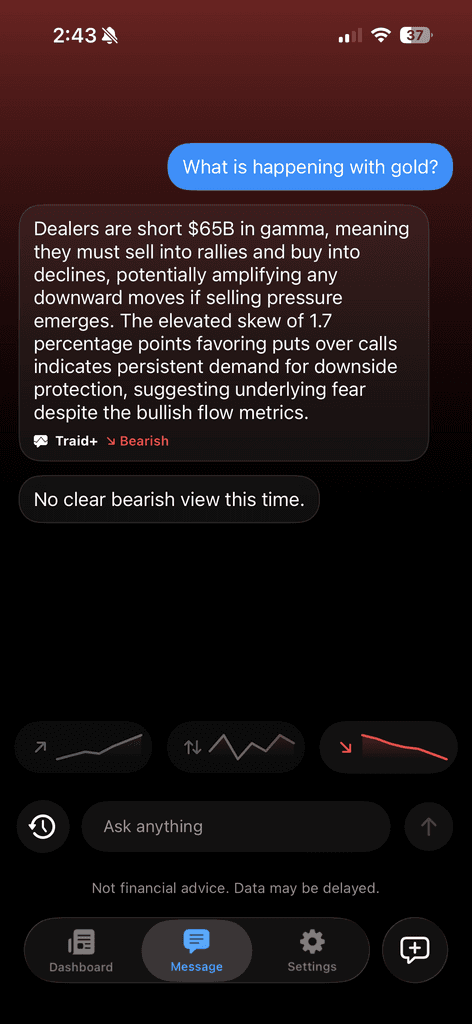

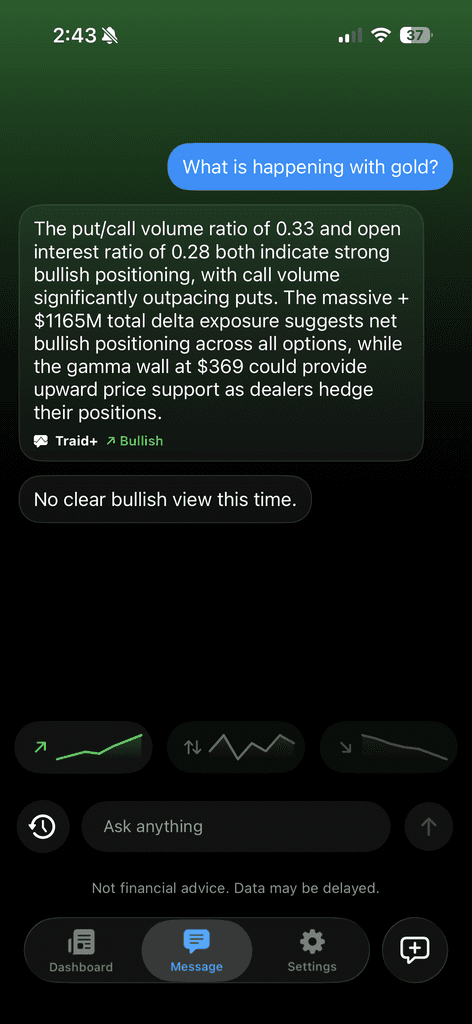

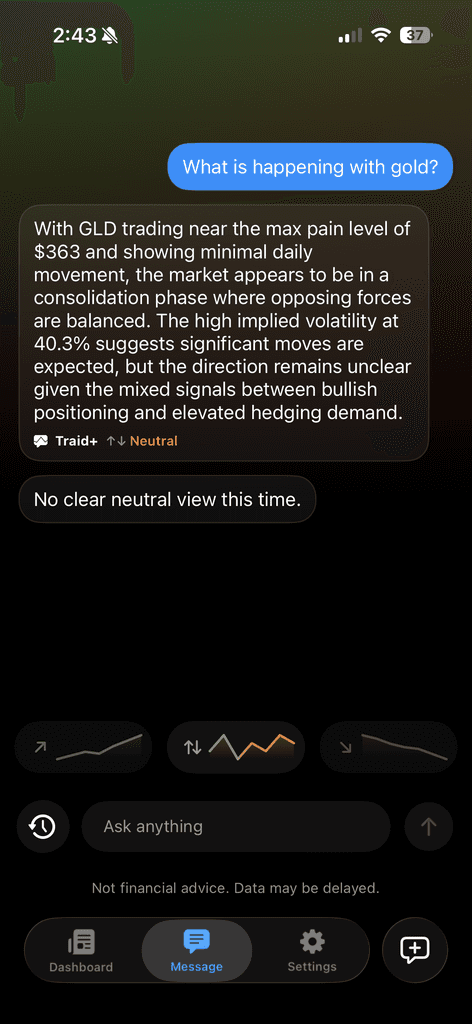

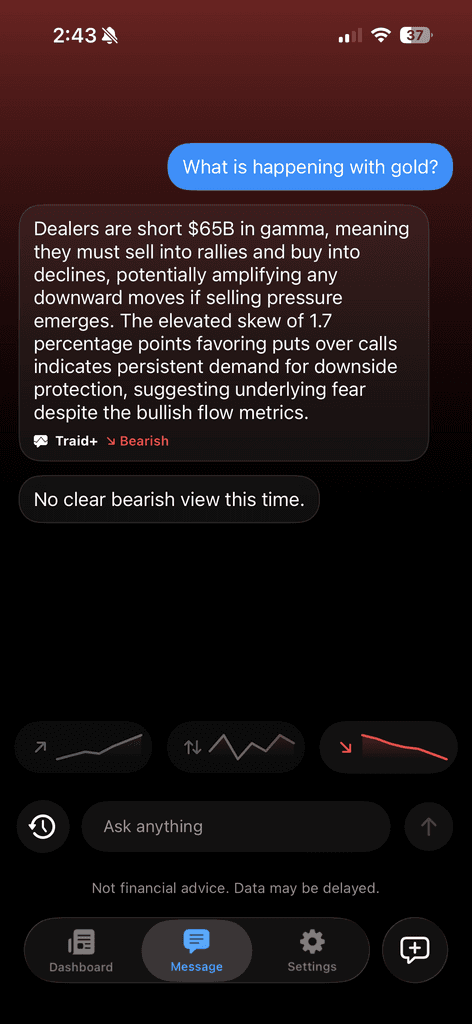

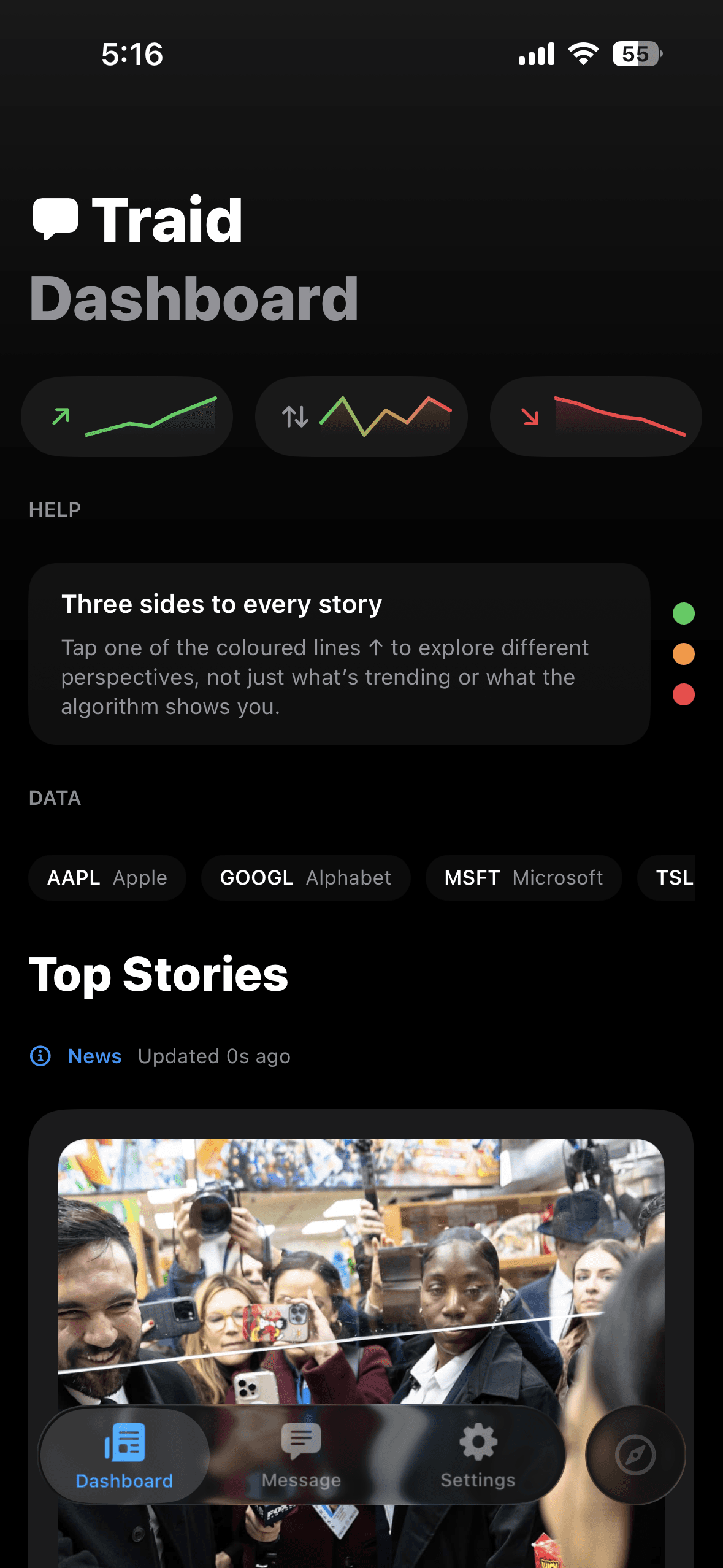

There's three sides to every story

There's three sides to every story

There's three sides to every story

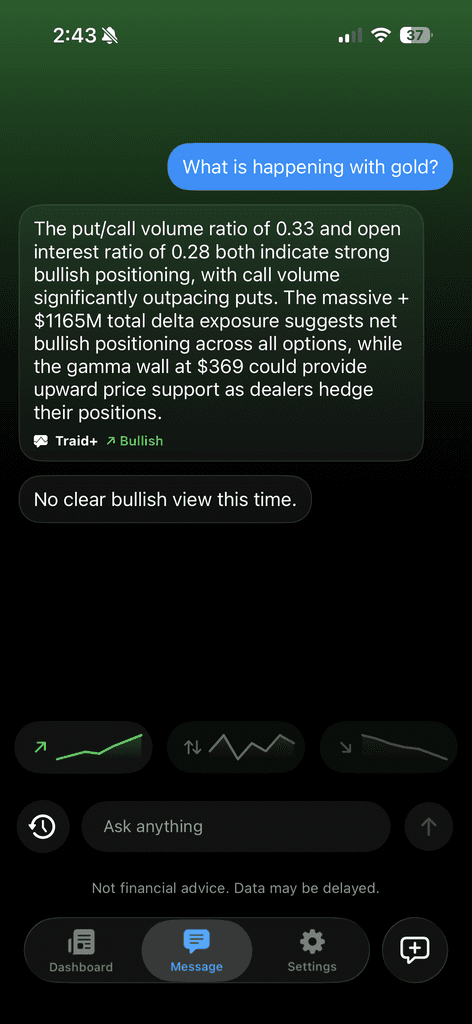

LLMs aren’t good at trading. They tend to mirror your tone. If you sound bullish, they’ll agree; if you’re doubtful, they’ll agree with that too.

Intelligence Integration

LLMs tend to echo your mood, bullish if you are, cautious if you aren’t. Traid makes that bias explicit: you choose bullish, bearish, or neutral. Giving you varied reasoning instead of agreement.

Intelligence Integration

LLMs tend to echo your mood, bullish if you are, cautious if you aren’t. Traid makes that bias explicit: you choose bullish, bearish, or neutral. Giving you varied reasoning instead of agreement.

Intelligence Integration

LLMs tend to echo your mood, bullish if you are, cautious if you aren’t. Traid makes that bias explicit: you choose bullish, bearish, or neutral. Giving you varied reasoning instead of agreement.

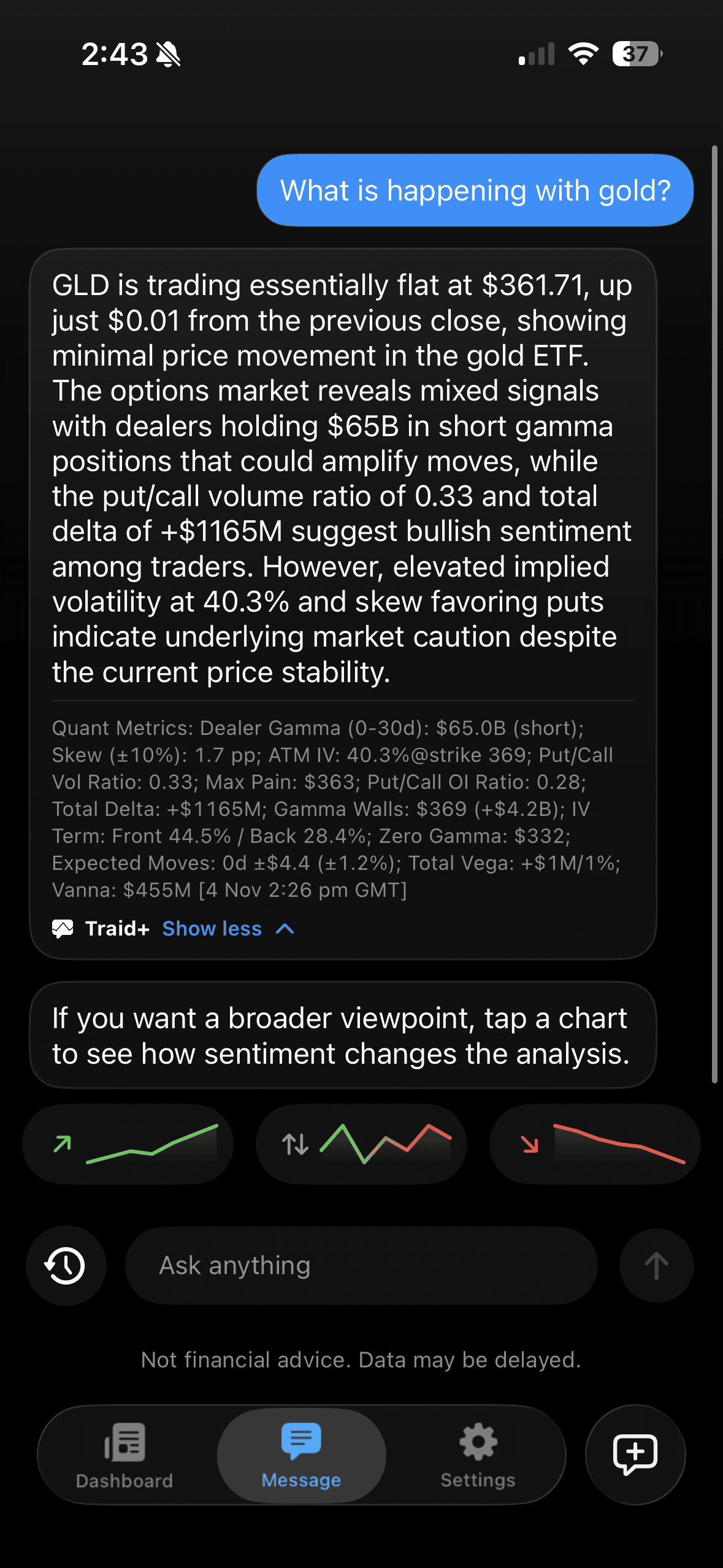

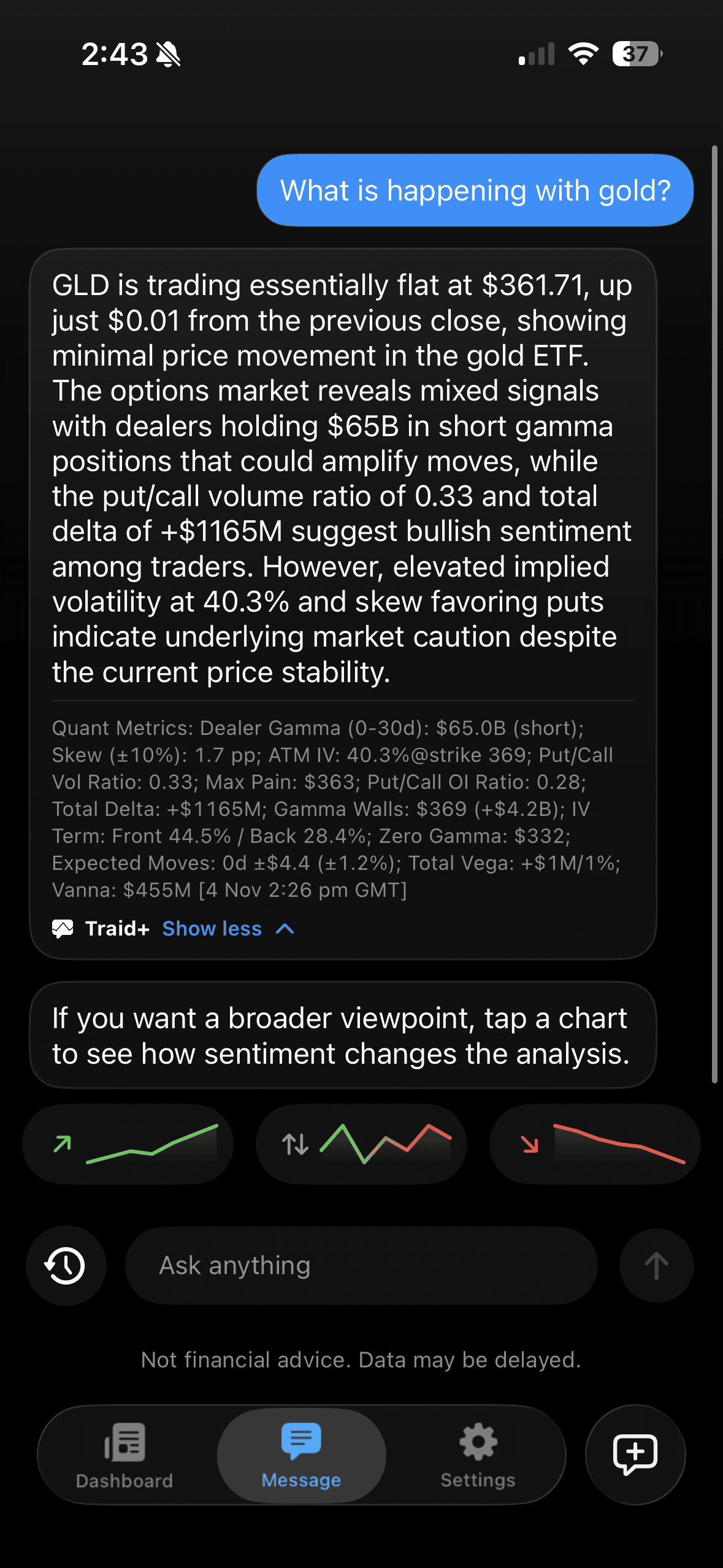

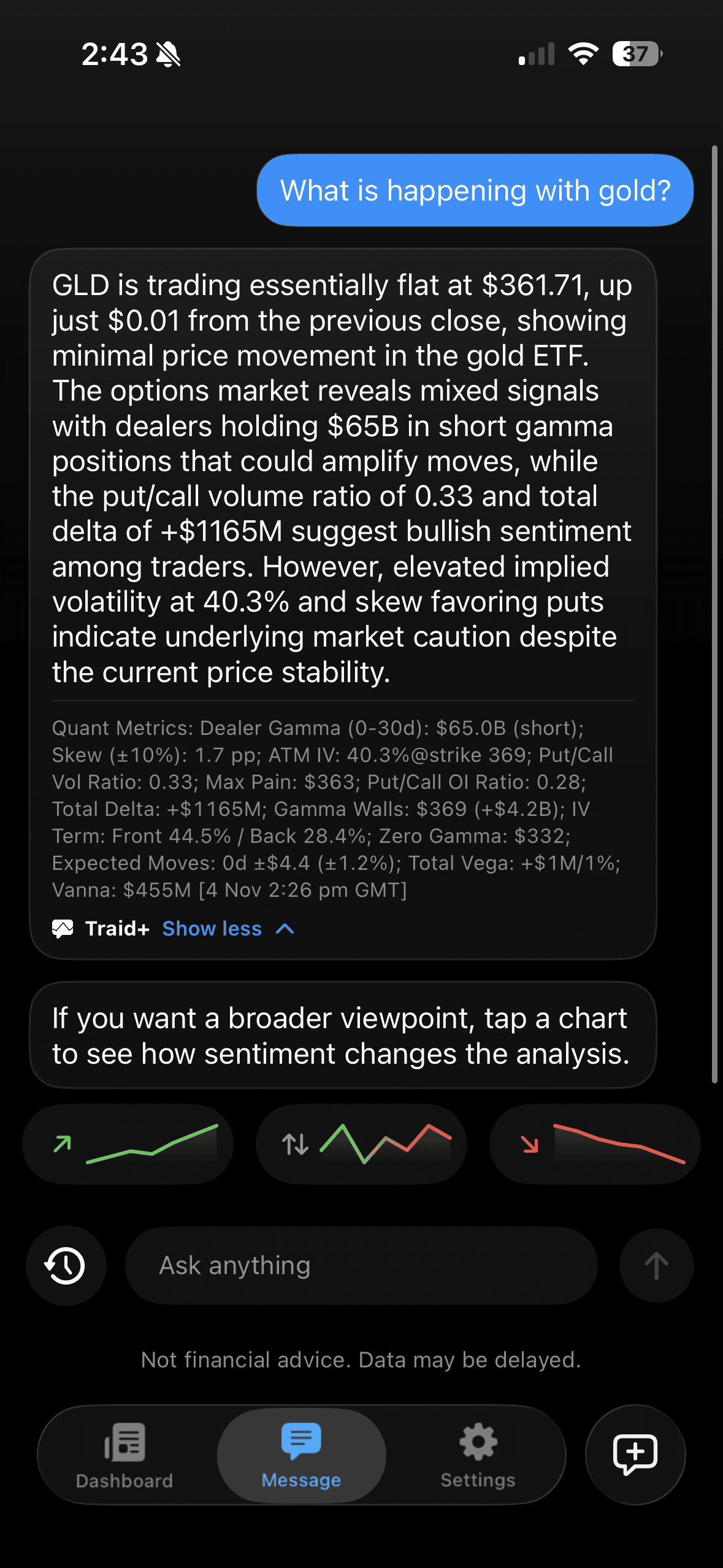

Quantitative Calculations

Traid calculates dealer gamma, volatility skew, implied vol, put/call ratios, and expected moves from live options data. Real Black-Scholes mathematics, then LLM translates the numbers into plain English. Every metric is computed, never hallucinated.

Quantitative Calculations

Traid calculates dealer gamma, volatility skew, implied vol, put/call ratios, and expected moves from live options data. Real Black-Scholes mathematics, then LLM translates the numbers into plain English. Every metric is computed, never hallucinated.

Quantitative Calculations

Traid calculates dealer gamma, volatility skew, implied vol, put/call ratios, and expected moves from live options data. Real Black-Scholes mathematics, then LLM translates the numbers into plain English. Every metric is computed, never hallucinated.

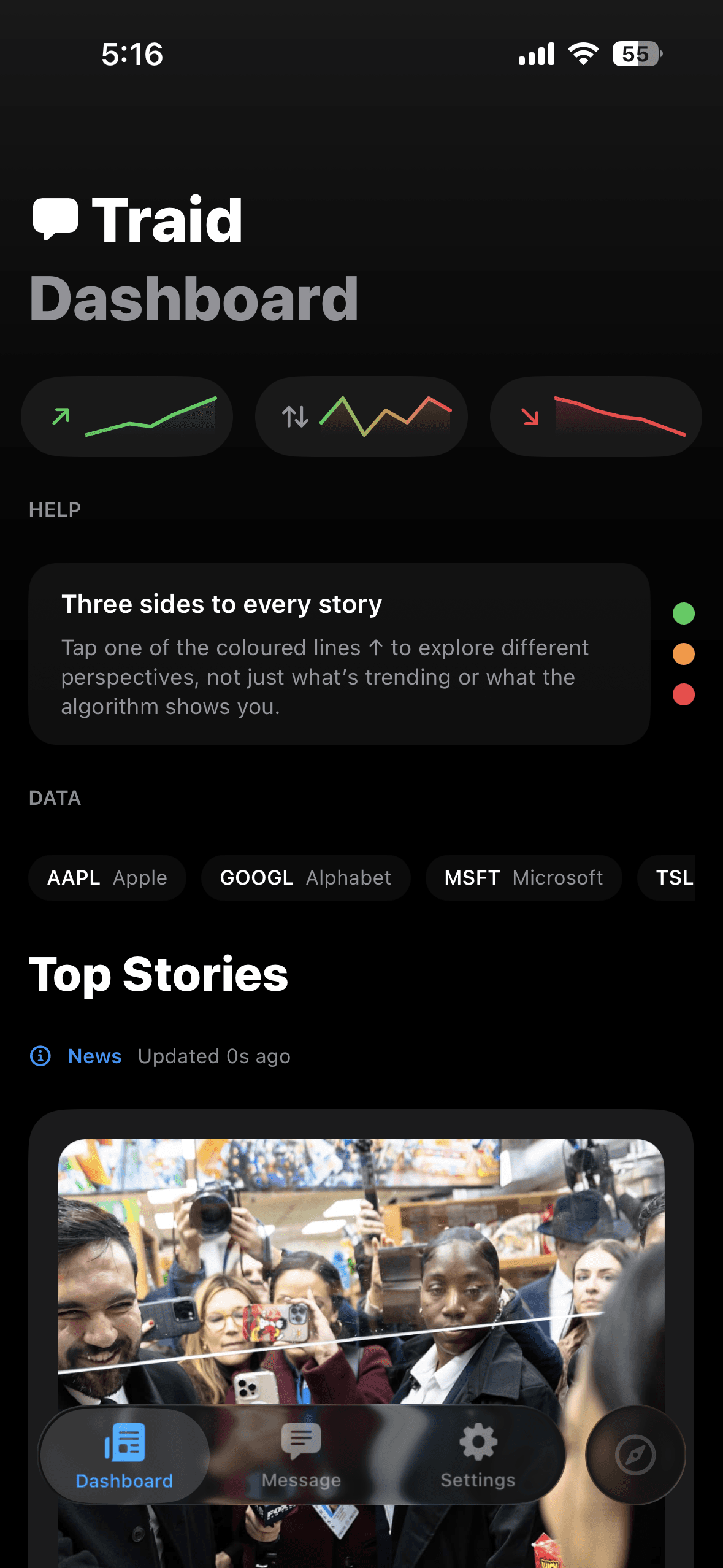

Apple

8 Updates

Microsoft

7 UPDATES

5 updates

Tesla

3 Updates

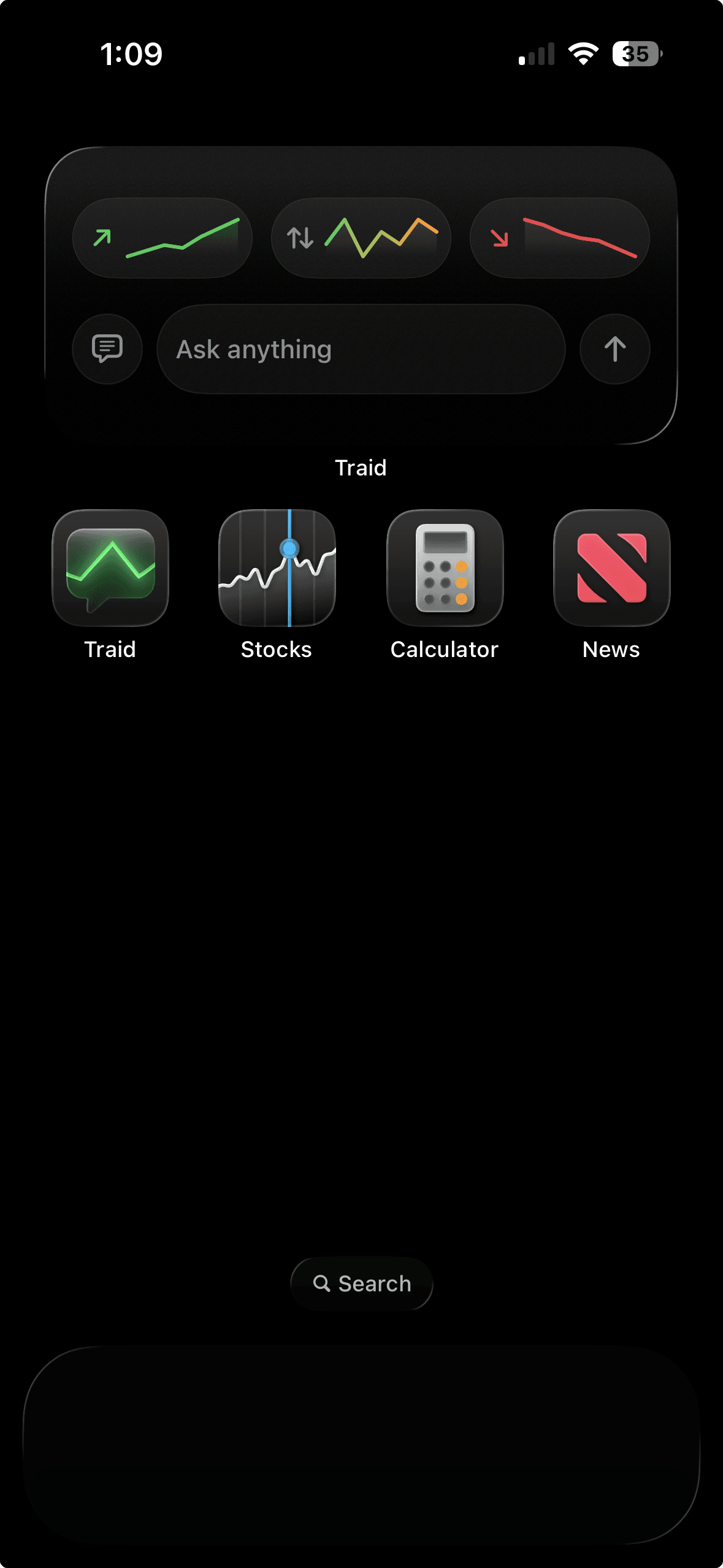

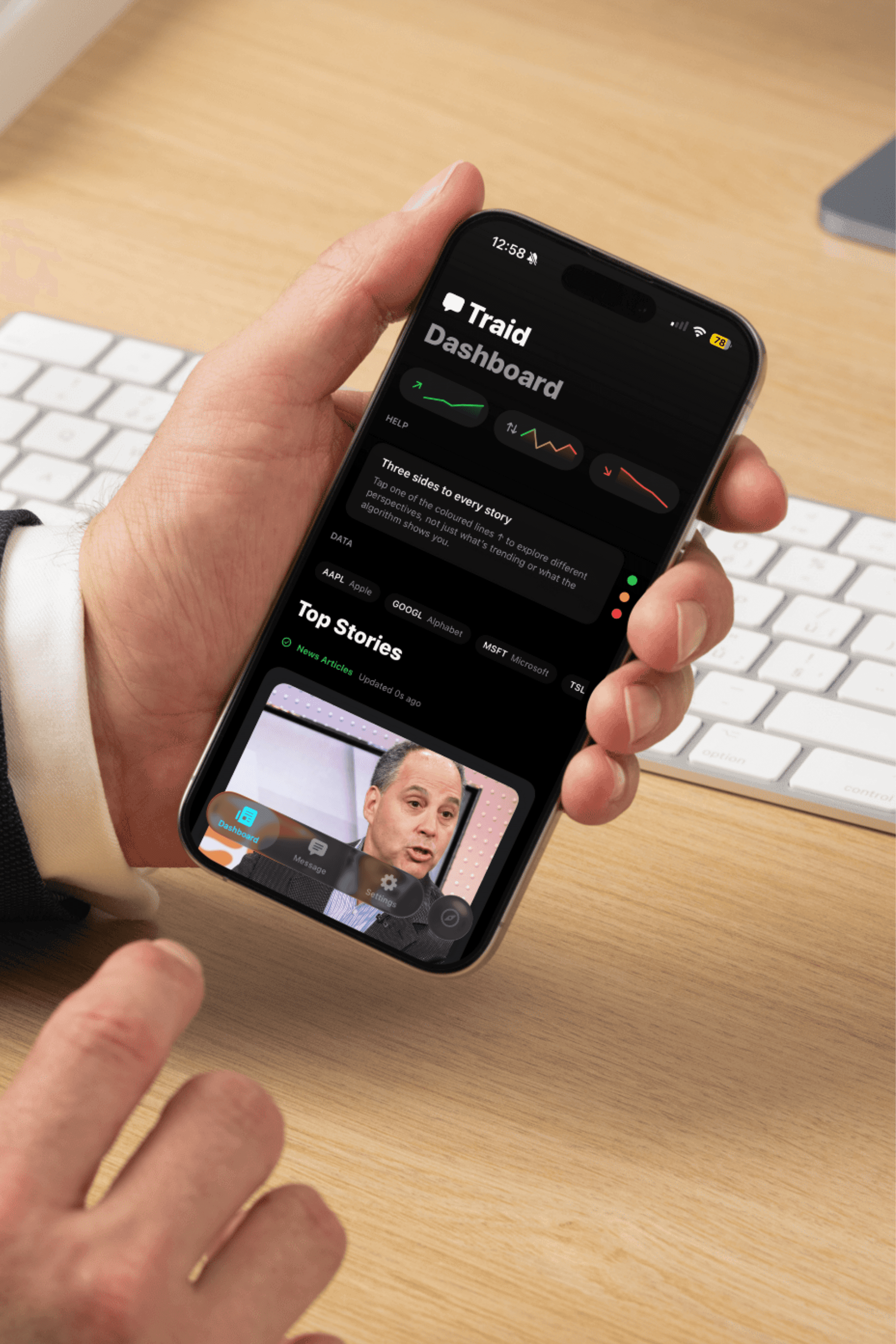

Watchlist

Keep a small list of tickers for quick context. They don’t fetch live prices or push alerts, they just help the model stay focused on what you actually follow.

Apple

8 Updates

Microsoft

7 UPDATES

5 updates

Tesla

3 Updates

Watchlist

Keep a small list of tickers for quick context. They don’t fetch live prices or push alerts, they just help the model stay focused on what you actually follow.

Apple

8 Updates

Microsoft

7 UPDATES

5 updates

Tesla

3 Updates

Watchlist

Keep a small list of tickers for quick context. They don’t fetch live prices or push alerts, they just help the model stay focused on what you actually follow.

Sentiment Layer

A small control layer sits between your input and the model. It lets you pick a stance, bullish, neutral, or bearish, and routes prompts accordingly. Not overconfident meaningless word salads.

Sentiment Layer

A small control layer sits between your input and the model. It lets you pick a stance, bullish, neutral, or bearish, and routes prompts accordingly. Not overconfident meaningless word salads.

Sentiment Layer

A small control layer sits between your input and the model. It lets you pick a stance, bullish, neutral, or bearish, and routes prompts accordingly. Not overconfident meaningless word salads.

Second Opinion

Traid works like a quiet teammate. You can talk through trade ideas, biases, or setups without it agreeing by default. It offers alternate angles and lets you test your thinking.

Second Opinion

Traid works like a quiet teammate. You can talk through trade ideas, biases, or setups without it agreeing by default. It offers alternate angles and lets you test your thinking.

Second Opinion

Traid works like a quiet teammate. You can talk through trade ideas, biases, or setups without it agreeing by default. It offers alternate angles and lets you test your thinking.

Stance set to Bullish for AAPL

12:41 AM

Expected move ±2.2% this week; call skew is...

“Fed hints at pause” Bearish

10:41 AM

IV up 10%; dealer gamma turns negative 440.

Neutral take on NVDA after earnings

20:41 AM

Metrics are balanced, ask Bullish or Bearish...

Market Reasoning

Traid is not for signals or predictions. It helps you slow down and look at how an argument is built. You can paste news, notes, or research and get a clear breakdown of what is fact, tone, and assumption.

Stance set to Bullish for AAPL

12:41 AM

Expected move ±2.2% this week; call skew is...

“Fed hints at pause” Bearish

10:41 AM

IV up 10%; dealer gamma turns negative 440.

Neutral take on NVDA after earnings

20:41 AM

Metrics are balanced, ask Bullish or Bearish...

Market Reasoning

Traid is not for signals or predictions. It helps you slow down and look at how an argument is built. You can paste news, notes, or research and get a clear breakdown of what is fact, tone, and assumption.

Stance set to Bullish for AAPL

12:41 AM

Expected move ±2.2% this week; call skew is...

“Fed hints at pause” Bearish

10:41 AM

IV up 10%; dealer gamma turns negative 440.

Neutral take on NVDA after earnings

20:41 AM

Metrics are balanced, ask Bullish or Bearish...

Market Reasoning

Traid is not for signals or predictions. It helps you slow down and look at how an argument is built. You can paste news, notes, or research and get a clear breakdown of what is fact, tone, and assumption.

Hear it from our users

Hear it from our users

Hear it from our users

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

"Traid has transformed the way I think about markets. Highly recommend!"

Test User

Traid has a friendly UI and is refreshing by giving me multiple perspectives in one

Trader

Traid has helped me escape the echo chamber and get important calculations done quickly

Junior Quant

"The sentiment feature makes me feel less oblivious and more aware"

Test User

How it works

How it works

How it works

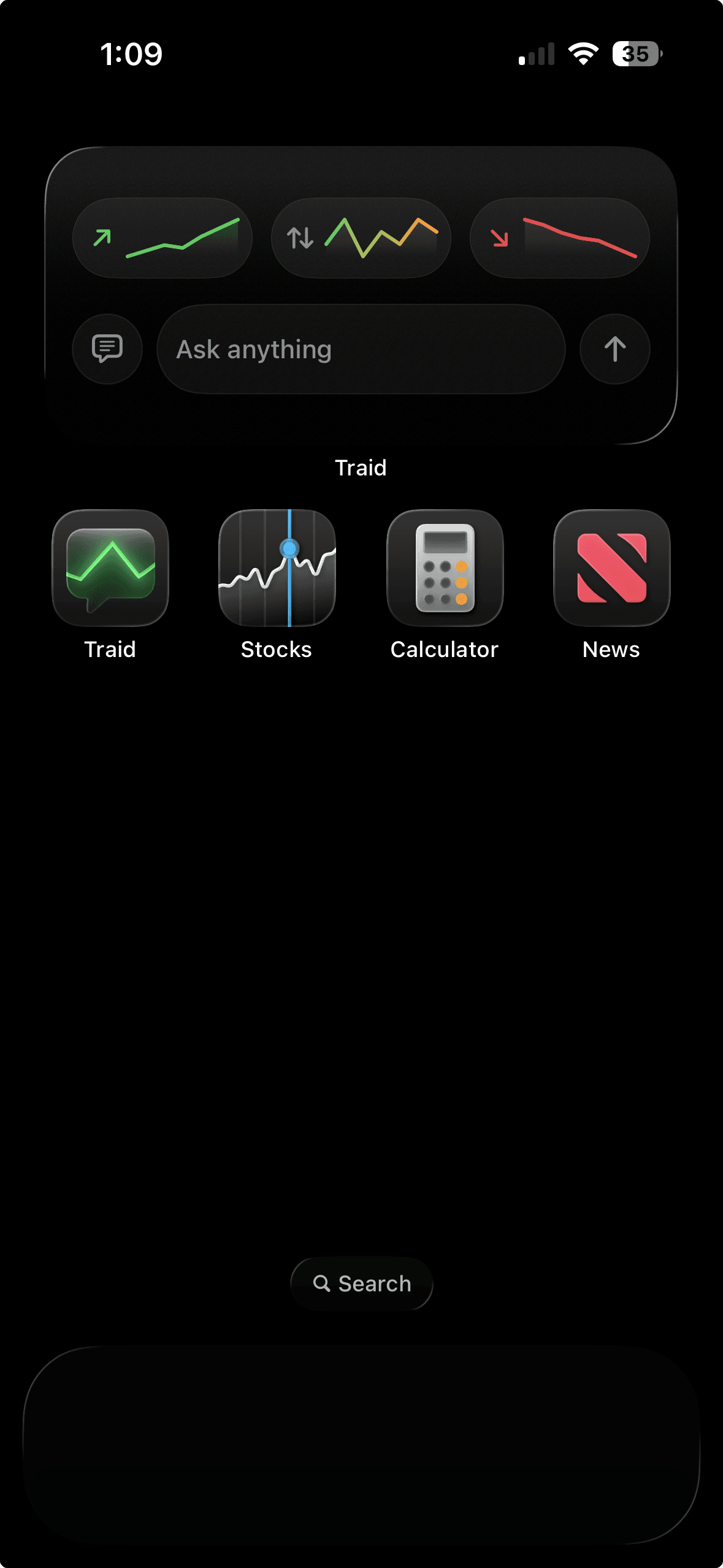

Click the options below to see the different screens

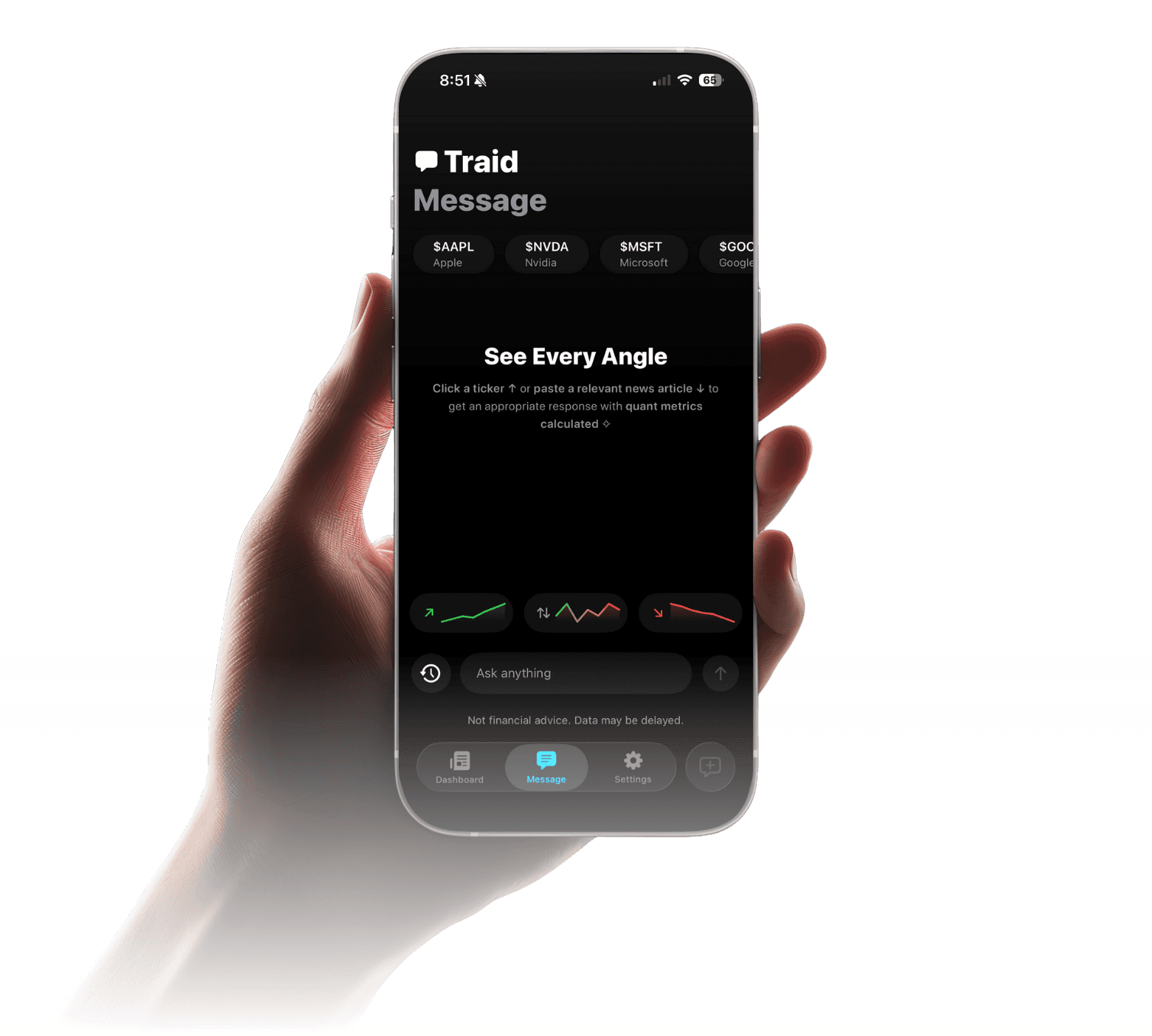

Choose Your Lens

Browse headlines or paste your own, then set the stance, bullish, neutral, or bearish, to frame the analysis.

Ask About a Ticker

Type any stock and get bullish/neutral/bearish answers backed by quantitative metrics and options math (IV, expected move, gamma, and more).

Paste Links for Context

Drop in any article or post; Traid extracts the facts, tags the sentiment, and reruns the same metrics through your chosen lens.

Choose Your Lens

Browse headlines or paste your own, then set the stance, bullish, neutral, or bearish, to frame the analysis.

Ask About a Ticker

Type any stock and get bullish/neutral/bearish answers backed by quantitative metrics and options math (IV, expected move, gamma, and more).

Paste Links for Context

Drop in any article or post; Traid extracts the facts, tags the sentiment, and reruns the same metrics through your chosen lens.

Choose Your Lens

Browse headlines or paste your own, then set the stance, bullish, neutral, or bearish, to frame the analysis.

Ask About a Ticker

Type any stock and get bullish/neutral/bearish answers backed by quantitative metrics and options math (IV, expected move, gamma, and more).

Paste Links for Context

Drop in any article or post; Traid extracts the facts, tags the sentiment, and reruns the same metrics through your chosen lens.